How To Hedge Forex Currency Binary Options Example

Contents

- No-bear on trade opportunity

- Protecting against risks

- No hedge

- Simple spot hedge without stop-loss

- Simple spot hedge with finish-loss

- Provisional spot hedge with stop-loss

- Which hedge model to choose?

- The actual trade

- A note on swaps

- Case study results

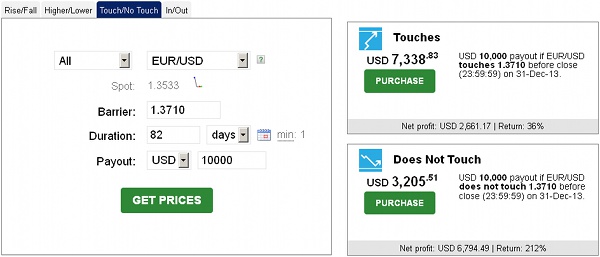

Back in 2013, inspired by a poll on the future of the EUR/USD currency pair, we decided to behave a small example study on combining a traditional FX trade with a binary no-bear on trade to hedge some of the risks. That experiment is described below.

No-impact trade opportunity

Usually, we exercise not merchandise binary options as the pricing is as well high in my opinion. What I mean is that if you add prices of two contrary direction options (e.g., touch and

This case is rather different. First, at that place is no 100% certainty that EUR/USD will not reach 1.3710 level by the end of 2013, but that level looks similar a meaning resistance for the currency pair. So, the current price on

Protecting against risks

No hedge

You may decide to skip the hedging part completely and risk your full stake to get $ii for each $one risked in case EUR/USD does not achieve 1.3710 during the remaining 82 days earlier December 31, 2013. Here are the possible outcomes and your turn a profit/loss for this example (hither and on, we will use $100 contract as an instance):

1. EUR/USD does non bear on 1.3710 — you win and get a $67 profit.

two. EUR/USD touches 1.3710 — you lose and book a $33 loss.

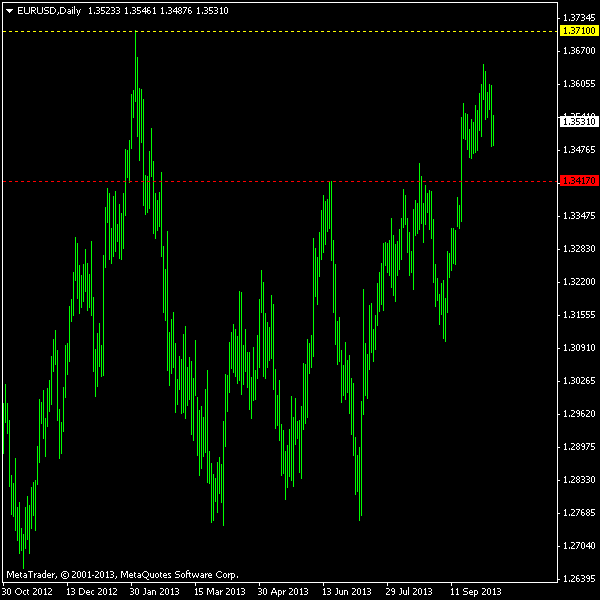

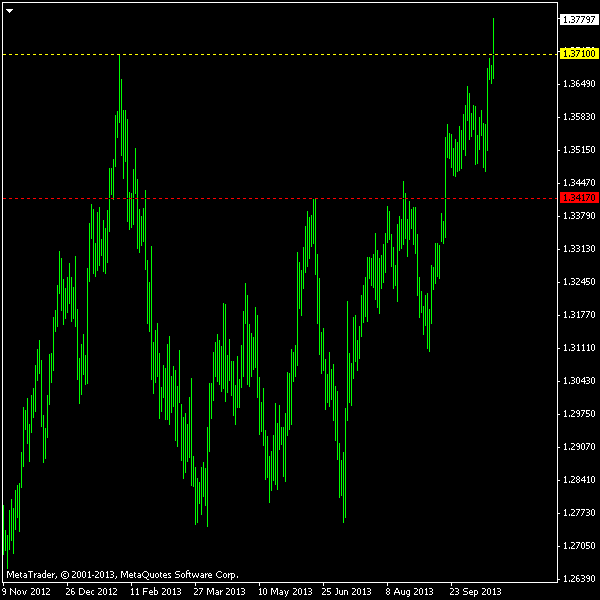

Decision: simple, straightforward way to bet on an result. The option strike cost (yellow line) and the major support level (red line) are marked, but no hedging is visible on the chart below:

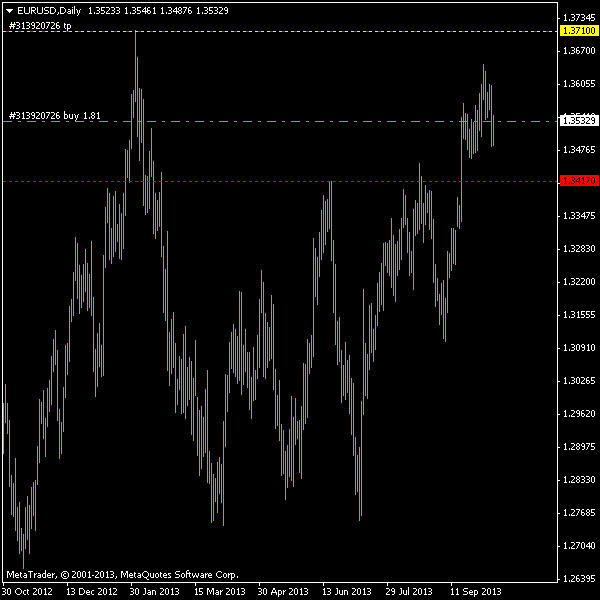

Elementary spot hedge without stop-loss

If losing $33 in example of a EUR/USD price hitting 1.3710 sounds too dangerous, yous may decide to hedge your binary contract with a especially sized spot Forex transaction. Since we are aiming to compensate for the instance when EUR/USD goes up to i.3710, we can easily say that we demand abuy order with 1.3710

ane. EUR/USD reaches 1.3710 during the period — binary options contract loses $33, spot position earns $33, net result: $0.

2. EUR/USD ends the menstruum above i.3532 (hedge position entry level) andbelow i.3710 without touching it — binary option contract yields $67 profit, spot position earns $0-$33 (eighteen.54 cents per pip), net event: $67-$100 profit.

three. EUR/USD ends the period below one.3532 but higher up i.3354 without touching 1.3710 level — binary pick contract however yields $67 profit, simply the spot position loses up to $67 (18.54 cents per pip), net effect: $0–67 profit.

four. EUR/USD ends the catamenia beneath 1.3354 without touching 1.3710 level — binary pick contract nevertheless yields $67 profit; spot position becomes a major loser with uncapped potential for loss (18.54 cents per pip), internet result: $0-$∞ loss.

Conclusion: unproblematic hedging with a single position and a single calculation routine — the position size based on distance between current rate and pick's strike price. The perfect outcome here is when the price remains between one.3710 (the option's strike) and the spot position'southward open level. The only losing scenario is EUR/USD finishing far below the spot entry level, which still gets partially compensated by the binary option win. Information technology can be recommended when you are confident that the market will be

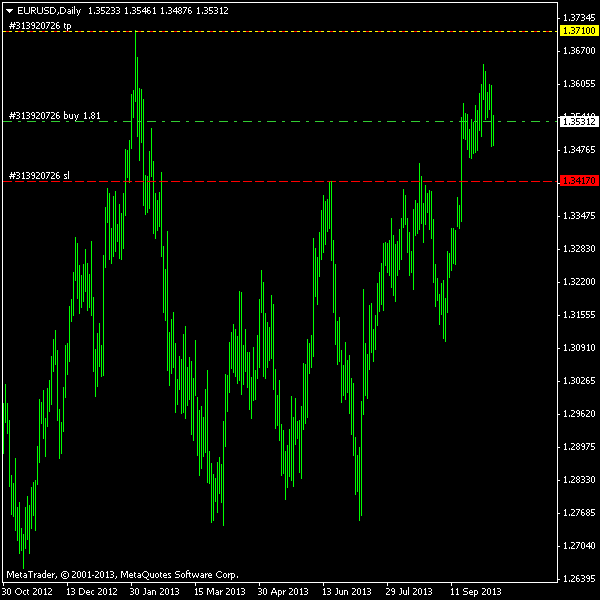

Simple spot hedge with terminate-loss

If you get a panic assail from thinking most unlimited loss that is possible in the previous scenario, y'all might desire to lock your potential drawdown with a

one. EUR/USD reaches 1.3710 during the menstruation before hitting SL — the binary options contract loses $33, spot position earns $33, net result: $0.

2. EUR/USD ends the period to a higher place i.3532 (hedge position entry level) andbelow one.3710, touching neither it nor SL — the binary option contract yields $67 profit, spot position earns $0-$33 (eighteen.54 cents per pip), net effect: $67-$100 profit.

three. EUR/USD ends the flow below i.3532 only in a higher place i.3417 (SL) without touching the 1.3710 level — the binary pick contract still yields $67 profit, just the spot position loses upwards to $21.32 (18.54 cents per pip), internet result: $45.68-$67 profit.

4. EUR/USD ends the menses without reaching 1.3710, but having triggered SL — the binary pick contract nonetheless yields $67 turn a profit; spot position ends with $21.32 loss (18.54 cents per pip), net outcome: $45.68 profit.

5. EUR/USD reaches SL start, then proceeds to 1.3710 — the binary option contract results in $33 loss; spot position ends up with $21.32 loss (18.54 cents per pip), net effect: $54.32 loss.

Conclusion: as yous can see, there are five distinct outcomes at present. All but two lead to meaning profit (compared to the initial risk on binary option). 1 leads to a zero gain. Simply one event is actually bad — when the price goes down to spot position'due south SL starting time and and so proceeds to a new yearly loftier. The loss at that place is more than double of the initial hazard. How probable is such an issue greatly depends on the chosen SL and the EUR/USD volatility during the period. The

Conditional spot hedge with stop-loss

If you lot really detest losing big amounts, you can consider adding a small twist to the SL hedge model — a conditional exit out of the binary option. The initial settings are the aforementioned as with the simple SL hedge model — TP, SL, position sizing, and all. Simply at present, since you can sell your

ane–3. The first three outcomes are the aforementioned as in the previous model.

4. EUR/USD ends the period without reaching ane.3710, but having triggered SL. The spot position results in $21.32 loss (18.54 cents per pip), but the binary choice sale yields some profit. As the electric current EUR/USD price is now below your selection entry price, its value tin be anywhere between $33 and $100, which means $0-$67 profit. Net result: between $21.32 loss and $45.68 profit.

Conclusion: the new twist removes the previous worst result of $54.32 loss and adds an effect with a rather undefined loss/profit state of affairs. In fact, the farther is your SL from your spot entry toll and the less time left till the binary choice'south expiry, the higher is the option's selling price. There is one disadvantage with this hedging method — y'all have to sell the option contract manually unless your binary trading platform offers provisional sale on certain underlying cost. Information technology may be a difficult thing to practise both physically (e.g., yous are comatose when your SL is striking) and emotionally (east.m., y'all all of a sudden decide against selling your option).

Which hedge model to choose?

It totally depends on two factors: your forecast for the EUR/USD behavior and your risk tolerance:

- If yous just believe that EUR/USD will not ascension much before the twelvemonth's end and y'all are comfortable taking a

full-risk merchandise at it, and then there is no need to resort to hedging at all. - If you believe that EUR/USD has some potential for rising and yous take risk lightly, you tin can use thesimple spot hedge model without

stop-loss . Nevertheless, if you lot want to limit your spot exposure risks, and then the elementaryterminate-loss model is probably a better choice. - If you are agape of EUR/USD jumping wildly down then up and want equally little chance as possible, then theconditional spot hedge model with

stop-loss is your friend.

The actual merchandise

We will not be trading this position on a alive account, but instead we entered a virtual option trade and a demo spot trade. Nosotros have used a $10,000 contract instead of a $100 ane, so that hedging position could be entered with an verbal sizing using hundredths of a standard lot. Our exact

The MetaTrader screenshots that you see above are of our actual position. We will employ the uncomplicated hedging model with

A annotation on swaps

82 days is a rather long period to hold an open foreign exchange position. Commonly, your spot EUR/USD hedge position will incur swap payments for every day it is left overnight unless you are trading via

In reality, not all brokers summate their rollover interest logically or fairly. We have opened our hedge position on a demo account from Alpari, and they charge $0.70 per standard lot to hold a long position overnight (and then, that is -$1.27 per mean solar day for our case study example). They would be us paying $0.30 per standard lot for belongings a short EUR/USD position. The skilful thing is that our loss on swaps volition be rather small compared to the overall balance alter acquired past this hedged binary option trade. If we scale it down to $100 contract, it would be only $i.04 additional loss for 82 days, and the position could be closed by the

On the other paw, our live account broker (Exness) offers a $1.073 positive swap on long EUR/USD deals and a $ii.505 negative bandy on short EUR/USD deals. If we decided to conduct this hedging case written report with real money, we would be getting extra $1.94/day just for holding our hedge position open.

Equally you can see, swaps are worth paying shut attention to when setting upwardly a hedge position. Yous could be either earning some small additional income or losing slightly from them. In our opinion, the former is a preferred option in nearly all cases. Past the way, did you notice an arbitrage opportunity that exists between Alpari and Exness swaps? Merely that is a completely different story.

Example study results

So today, on October 22, 2013, the EUR/USD currency pair has finally surpassed its previous maximum for 2013 and thus has finalized our case study research. The

The resulting EUR/USD chart:

Disclaimer: The links to Binary.com used above are affiliate links. Here is a direct link to their website if y'all adopt: https://www.binary.com/. You may as well endeavour to find better trading atmospheric condition with other binary brokers.

PS: You might be interested in this hedging calculator if you are serious about this trading technique.

If you have some questions about the proposed ways of hedging a binary trading position using a spot trade, y'all can discuss information technology on our Forex forum.

If y'all want to become news of the most recent updates to our guides or anything else related to Forex trading, you can subscribe to our monthly newsletter.

Forex trading bears intrinsic risks of loss. Y'all must empathise that Forex trading, while potentially profitable, can brand you lose your money. Never trade with the money that you cannot afford to lose! Trading with leverage can wipe your account even faster.

CFDs are leveraged products and as such loses may be more than the initial invested capital. Trading in CFDs carry a loftier level of risk thus may not exist appropriate for all investors.

How To Hedge Forex Currency Binary Options Example,

Source: https://www.earnforex.com/guides/hedging-binary-option-with-spot-fx-trade-case-study/

Posted by: nolannothiphop.blogspot.com

0 Response to "How To Hedge Forex Currency Binary Options Example"

Post a Comment